The Superannuation Guarantee Amnesty has ended on 7 September 2020.

If you currently have any unpaid Superannuation Guarantee or have paid any amounts late, you will be required to lodge a Superannuation Guarantee Charge Statement and pay any interest or fees levied by the ATO.

To ensure your employee’s superannuation funds receive these payments in time, you should submit your superannuation payments in your accounting software at least 4 business days before they fall due.

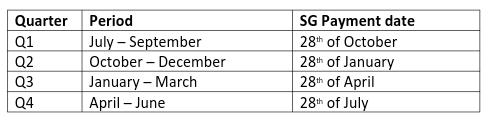

Superannuation Key Dates:

When a due date falls on a weekend or public holiday, you can make the payment on the next working day.